With Hinkley Point already behind schedule a Plan B is urgently required - thankfully the government's imminent Clean Growth Plan provides the perfect opportunity to deliver one

Hands up if you are surprised. In an age of 360-degree unpredictability it is strangely reassuring to discover some things never change. The sun comes up in the morning, the tides ebb and flow, and European nuclear projects are late and over budget.

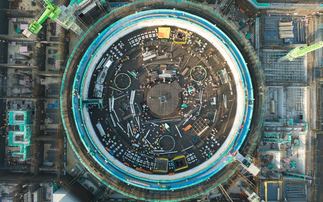

The revelation this week that EDF reckons its flagship Hinkley Point project is already 15 months behind schedule and £1.5bn over budget is the least surprising news since confirmation Donald Trump spent the weekend playing golf.

However, there are still a few surprises to be found in EDF's response to the latest setback. That out-going chief executive Vincent de Rivaz - he of the turkey to be cooked using power from Hinkley Point this Christmas - can argue with a straight face that the 15 months the project is behind schedule can be made up and the project can still be online by 2025 as planned is a truly astonishing example of managerial (over?) confidence.

Inevitably, the schadenfreude now emanating from some environmentalists is so fulsome even a Brussels diplomat looking at the latest UK inflation figures might think it a bit much. Throw the recent woes at Toshiba and the National Audit Office's (NAO) damning assessment of the Hinkley deal into the mix and it is hard to shake the impression of a nuclear industry facing a crisis that it seems increasingly ill-equipped to navigate. Hopes of a UK nuclear renaissance look wobblier than ever.

However, before anyone starts celebrating the challenges facing EDF it is crucial to remember the project and the huge quantities of clean power it is expected to deliver remain of strategic importance to both the UK's energy security and its climate goals. Many environmentalists may want to see the project cancelled, but further delays or full blown abandonment of the project risk dealing a major blow to the UK's decarbonisation efforts.

Amber Rudd admitted as much when she was Energy and Climate Change Secretary, confirming that delay to the project could push up energy bills and "put at risk our decarbonisation targets". The seven per cent of the UK's power Hinkley Point is meant to provide may come at a sizeable cost, but it will be challenging to replace with clean power if the project is badly delayed.

Consequently, the crucial question now for the government is where is Plan B? How do we ensure carbon targets are met even if Hinkley Point and the nuclear projects that were meant to follow it falter?

The answer, thankfully, is staring the government in the face.

There was a different sort of surprise earlier this year, an extremely welcome one. The Department for Business, Energy and Industrial Strategy (BEIS) quietly confirmed that it expects renewable power deployment to be significantly higher than previously thought beyond 2020, primarily due to the plummeting cost and surging popularity of solar power and storage technologies.

BEIS' projections now expect cumulative new build renewables capacity from 2016 to 2035 to reach 45GW, marking a sharp increase in the 2015 projection for 33GW of new capacity. The energy supply gap that would be created by Hinkley Point delays is already narrower than feared just a few months ago.

Better still, another happy surprise could come later this autumn with the results of the government's latest clean power contract auction for offshore wind projects. The rumour is the bids will be extremely competitive, promising to deliver offshore wind at a price well below the guaranteed rates being offered to Hinkley Point. The government should be able to purchase a lot more clean power capacity than expected for the same outlay, narrowing any Hinkley-related supply gap still further.

Such an encouraging outcome would still come with some sizeable challenges in tow, however. The temptation to take advantage of increasingly cost competitive offshore wind should not be used as an excuse to curb overall support for clean energy, nor as a justification for continuing to deny onshore wind, solar, marine energy, and even small modular reactor and carbon capture technologies a viable route to market. If it is foolhardy to put too many eggs in the nuclear basket it is equally risky to make the same mistake with offshore wind.

In addition, increased reliance on renewables would inevitably demand accompanying investment in the smart grids and energy storage systems, to ensure a renewables-heavy grid remains stable.

In another welcome coincidence, this is precisely the ground the government's Clean Growth Plan should cover. Climate Minister Claire Perry's decision to strengthen the strategy over the summer suddenly looks prescient; she could do with the flexibility a more ambitious plan would offer in the event the Hinkley project delays start to make Southern Trains look like an exemplar of reliability.

As the Guardian's Nils Prately observed this week the timing of EDF's review is strange and will only serve to fuel fears that it could end up asking the government for yet more support. But the early review has also done the government a favour in that it provides it with the opportunity to now incorporate a credible Plan B into its Clean Growth Plan. If seven per cent of UK power is not going to come online as expected Ministers have a responsibility to redouble efforts to curb overall power demand through energy efficiency measures and make greater use cost competitive renewables in order to minimise the use of back up gas plants.

Setting out such a strategy will not only help mobilise much needed investment and increase the chances of the UK's carbon targets being met, it will also give the government some leverage in the event that EDF does end up calling for more support for its controversial project. Unlike the last round of negotiations that the NAO rightly criticised, this time around Ministers would have a credible fall-back position that could allow them to walk away from the project if necessary.

And if EDF surprises everyone and actually delivers the project on time and on budget then - from an emissions perspective at least - that's all to the good. If renewables can over deliver and new nuclear can provide the power that is expected from the mid-2020s onwards then the net result will simply be the UK pushing fossil fuels off the grid a little earlier than expected.

There are plenty of very good reasons to condemn the financial aspects of the Hinkley Point deal and fear they could be repeated with other future reactors, but it is worth remembering that under the government's plans new nuclear is meant to broadly replace retiring reactors and renewables are meant to replace fossil fuels. It is important that a renewables-dominated Plan B is available, not least because it remains highly probable that Hinkley Point will be delayed further. But there are also good reasons to hope Plan A can still be delivered. Without any nuclear online the already sizeable challenge to decarbonise the power system and meet new demands from electric cars and green heat technologies becomes even more acute.

The paradox of Hinkley Point remains that the UK should work hard to deliver the project, while simultaneously working to prove that emerging clean technologies mean it was never required. And that somewhat bizarre outcome shouldn't surprise anyone.